Project Description

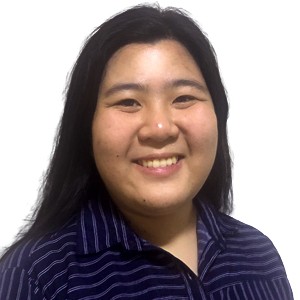

Julian Tennant

Program Director

Areas Of Expertise

- Project Management Delivery

- Problem Solving & Analytics

- Stakeholder Management

- Transformation and Strategy

Education

- Certified International Project Manager, CIPM

- Graduate Diploma of Applied Finance & Investments, FINSIA

- Bachelor of Commerce (Accounting & Business Studies), University of Canterbury

About Julian Tennant

Julian has more than 20 years of experience in project management, transformation, and strategy across multiple geographies and a wide range of financial service sectors. He possesses excellent stakeholder management skills and has a track record of delivering outstanding initiatives. Julian is a strategic and creative thinker with strong business acumen and a proven ability to deliver solutions. He embraces and easily adapts to new challenges with a solution-focused mindset.

What Julian brings

- With strong background in project and program management.

- Built strong and trusted relationships with Senior Leaders and stakeholders.

- Delivering teams transforming from legacy systems and processes to reimagined future states, using customer-centric and process redesign.

- Experienced in communicating, facilitating, and presenting from Board & CEO through to front and back office.

Key Clients:

- NSW Government

- NAB

- CBA

- Genpact

- Westpac

- Macquarie Bank

- Bankers Trust Australia

- TD Waterhouse

- Merrill Lynch International

- Westpac New Zealand

- Brambles

- Metcash

- SIAC Construction

Key Achievements

As PMO Director at the NSW Government Department of Climate Change, Julian led a Seven Consulting team that was brought in to address a number of program management requirements identified in an ICT health check of the Biodiversity Offset Scheme Digital Transformation Program. Deliverables included a rapid assessment of the program, followed by an efficient and effective design of required processes and artefacts to support successful delivery. A new program structure and governance framework was designed and implemented, as was a FY 2026 program roadmap and benefits realisation plan.

As Program Director at NAB, Julian was responsible for a $100m program to provide a new, flexible platform to support the Billing, Onboarding, Settlements and Servicing for the Merchant Services Business Domain and its customers. Julian was brought in to address issues identified in a program assurance review, to set up the incoming Program Lead for success by establishing greater planning, governance and opportunities to accelerate delivery across the program.

As Senior Program Manager at CBA, Julian developed a long-term network strategy and centralised space management function for direct channels within the Retail Banking Division. By leveraging the recent implementation of a $30M IVR system and aligning with the Retail Bank’s FY2016 strategy, he optimised the footprint of the direct channels businesses. His accomplishments include creating a comprehensive footprint strategy and program of work to deploy multiple modes of work, utilising stranded resources across RBS. This approach provided significant OPEX savings and accessed new talent pools, earning endorsement and funding for an initial pilot. He also successfully implemented the first working-from-home telephony agents by managing a cross-functional project team of up to 10 people and developing solutions to test this hypothesis. Additionally, he implemented branch agents to receive calls directly in branches.

As Program Manager at CBA, Julian was responsible for managing internal and external resources to deliver world-class sales capabilities within Direct Banking. He collaborated closely with internal stakeholders and external consultants, devised work streams that translated, customised, and tailored a new sales and service methodology for application within the Direct Banking business. His outputs included creating online best practice role guides for all lines of business and roles within Direct Banking, delivering standard sales and leadership capabilities assessment, and utilising Visual Management Boards for performance management.

As Program Manager at CBA, Julian managed a $10m+ initiative to remediate 60 high-risk issues in the retail debt management business. He was responsible for resourcing, planning, actively managing identified risks and issues, and stakeholder management. His accomplishments include creating a 12-month implementation plan to address all high-risk issues, re-scoping solution streams to ensure effective remediation, and successfully remediating 55 issues by December 2012, on time, on budget, and delivering expected benefits. Additionally, he personally designed solutions for multiple issues, including adapting system functionality, data management, process design, and reporting as part of a system migration.

As Program Manager at CBA, Julian managed a series of bank-wide initiatives aimed at making the bank the market leader in customer satisfaction. He was brought into the role to project manage the implementation of customer satisfaction scorecards and CEO forums. His responsibilities included networking across the entire group, collaborating with the CEO office, group executives, heads of business, market research, and customer relations to ensure a fully engaged workforce focused on exceptional customer service. Key projects included preparing and presenting CEO briefings at monthly forums and analysing monthly customer service scorecards for all business units. He was nominated for the company’s leadership development program for executive managers, developing a model to engage over 40,000 employees with the bank’s customer service vision, and aligning internal customer service measures with customer expectations.

As Chief of Staff, Head Office at Genpact, Julian had a broad array of responsibilities including leading strategic initiatives such as partnerships, acquisitions, and industry events. He oversaw all reporting and meetings, including APAC Board sessions, Regional Town Halls, and Strategic and Advisory Councils. His responsibilities were to oversee performance governance, insights, and communication, as well as budget tracking, allocations, and contract execution. He acted on behalf of the Country Manager in APAC board and other CXO global forums. Additionally, Julian managed go-to-market strategy, short- and long-term account planning, and handled client and internal escalations.

As Director, Transformation Services BFSI at Genpact, Julian led teams of consultants and transformation specialists to drive initiatives within the banking and financial services industries across Europe, Australia, and New Zealand. As a trusted partner to major banks in these regions, he focused on delivering cost efficiencies, revenue growth, and improved customer satisfaction.

As UK Program Director, Julian managed the UK location strategy for a top 4 UK bank, from business case to deployment. To deliver their vision of banking in 2030 by 2020, operational centres were reduced from 11 to 3. Remaining operational staff were trained in Lean Six Sigma to identify further opportunities to streamline practises, digitise, reduce waste and improve customer experience. e.g. wholesale product onboarding TAT was reduced on average by 300%.

As Program Director he coordinated programs and resources for over 20 change initiatives across UK operations as part of a global transformation program. Mentored & coached direct reports and clients in business case writing and the use of project management tools to effectively manage their projects.

As Program Director at a New Zealand Bank, he led a broad program of initiatives for a New Zealand bank to introduce customer canvases, a people strategy for the workforce and process redesign for 3 main business areas. Customer Canvases provided Moments of Truth to focus on and deliver to customer expectations. The program delivered a future state model in finance operations, call centres and HR.

As Program Director at Bankers Trust Australia, he directed a team of consultants to create customer-centric materials for a major Australian bank’s IT business, shifting from a cost to service operating model. These materials allowed IT staff to prioritise & deliver IT products to staff in a manner that meet or exceeded their expectations and maximised their onboarding performance.